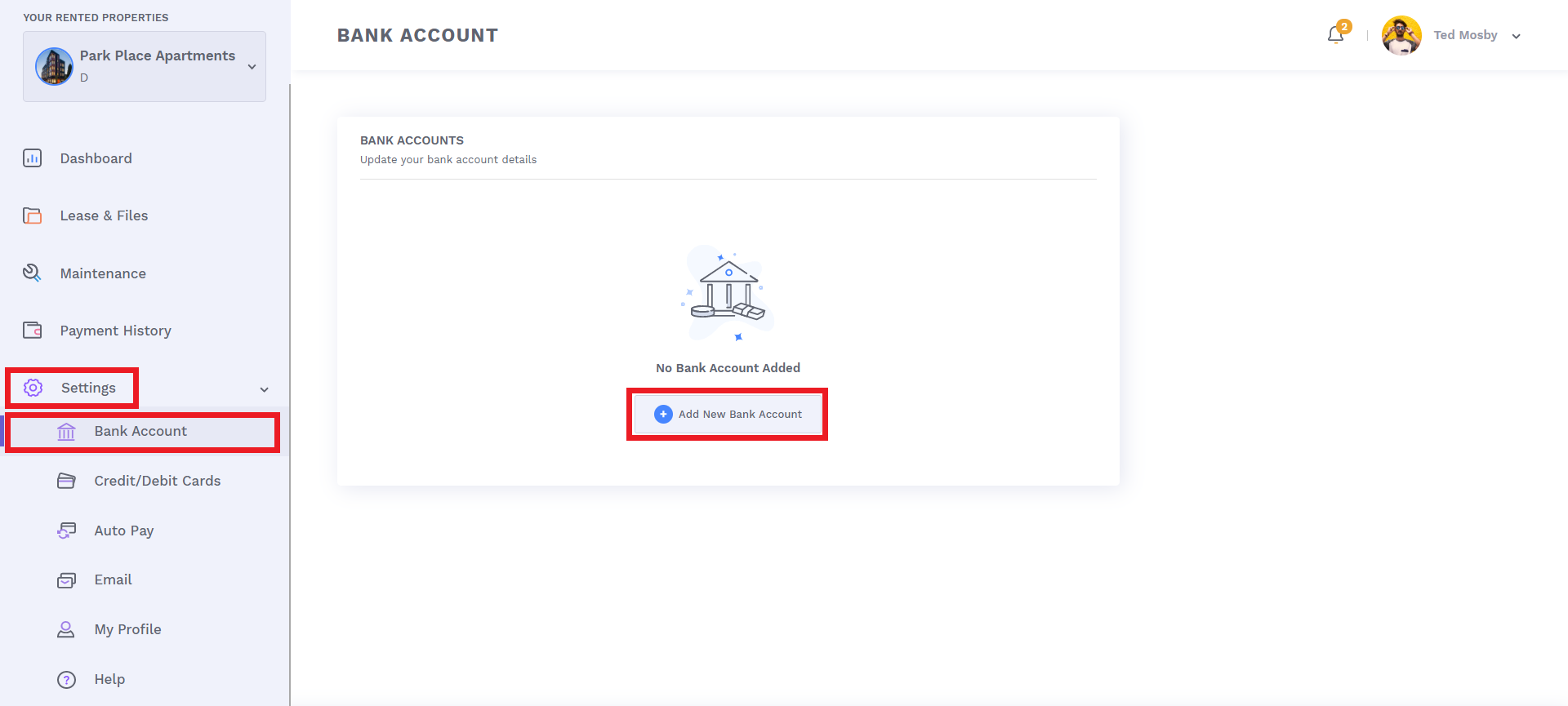

How to Add Your Bank Account to Innago

1. From the Innago menu on the left, click on ‘Settings‘.

2. Click on ‘Bank Account‘.

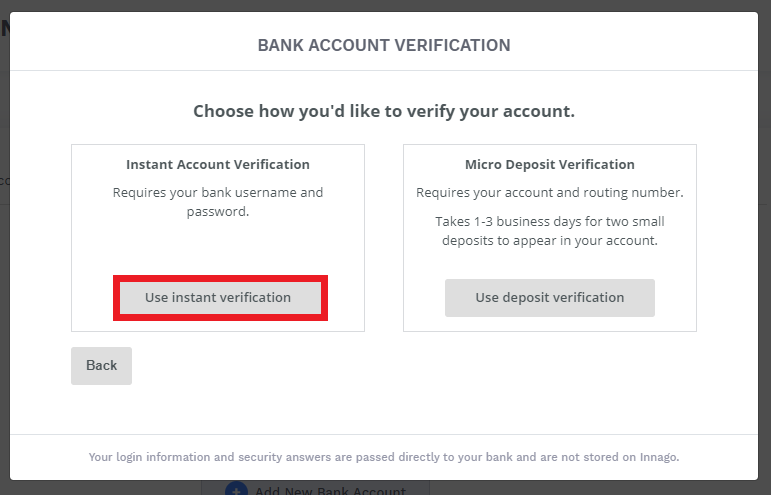

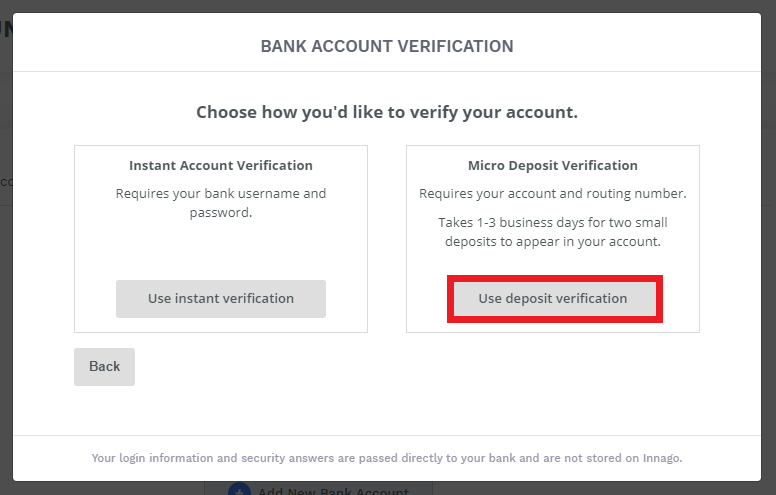

5. Here, you can choose to verify your account via Instant Verification or Micro-deposit Verification.

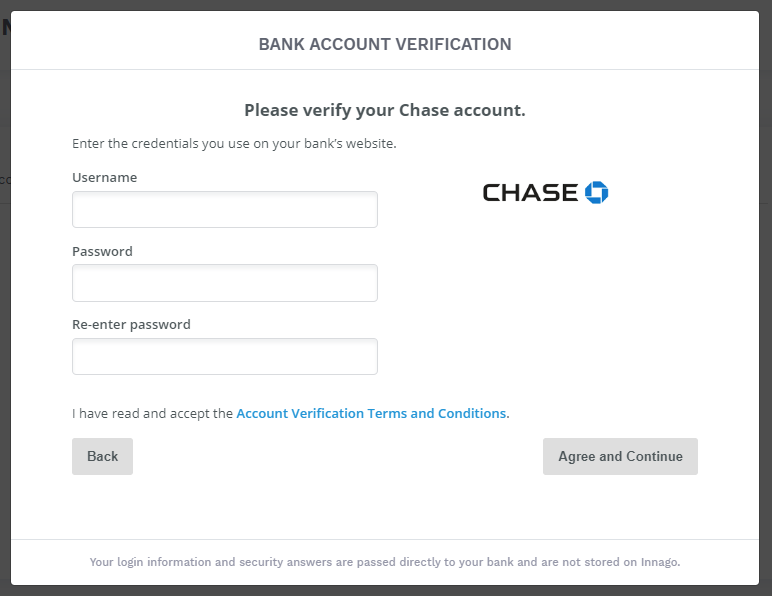

Verifying via Instant Verification

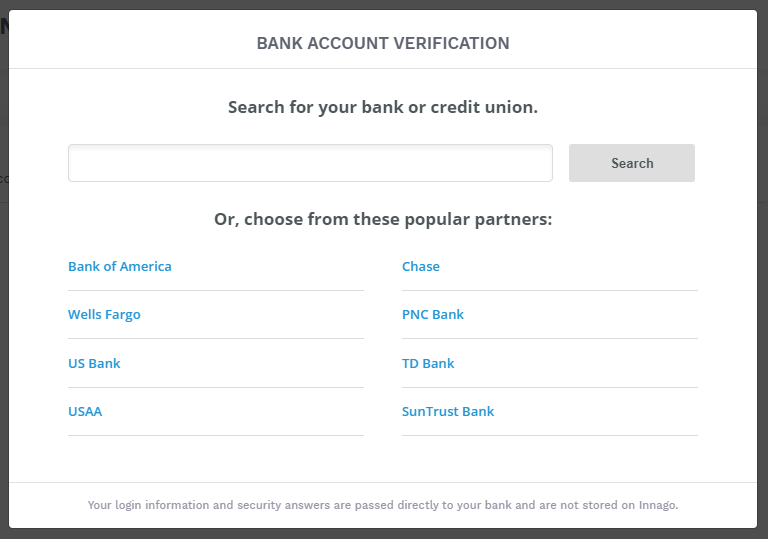

More than 80% of financial institutions offer you the ability to instantly verify your bank account. To do so, you’ll enter in your username, password, and any authentication information your financial institution requires.

If you experience an issue adding your bank account to Innago via instant verification, and you’ve double checked the information you’ve entered, your bank likely does not allow instant verification on third party sites. In this case, you will need to verify your bank account via the micro-deposit option.

Note: We cannot see or access your personal banking information at any time. Once verified, your bank simply passes us your account and routing number. It’s simple, secure, and fast.

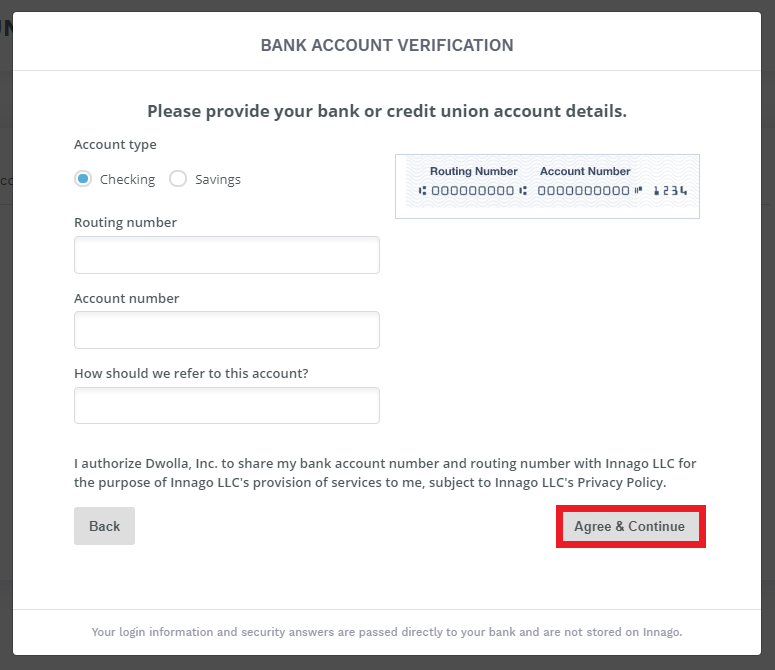

Verifying via Micro-Deposits

If your bank does not offer the ability to instantly verify your account or if you’d prefer not to do so, you can verify using micro-deposits. You will enter in your account and routing numbers. Two deposits, each less than ten cents will be sent to your account. Please note, if you’ve also just added a card linked to the same bank account, the 0.01 cent charges you see are NOT for your microdeposit verification. This is a 0.01 cent authorization for the card specifically. You will have to wait 24-48 business hours for microdeposits to arrive, and you’ll be notified via e-mail.

If the micro-deposit service is initiated on a business day before 5pm EST, the deposits will arrive the following morning by 11am EST. If you initiated this service after 5pm EST, then it would take an additional business day.

If you start the process after 5pm EST on a Friday, or anytime on a Saturday or Sunday, you can expect to see the deposits by Tuesday.

Once the micro-deposits have been deposited into your bank account, log into Innago and click ‘Verify Micro-Deposits‘ from the Dashboard screen. You’ll be taken to a screen to enter the two micro-deposit values you have received. Once entered, your bank account will be verified!