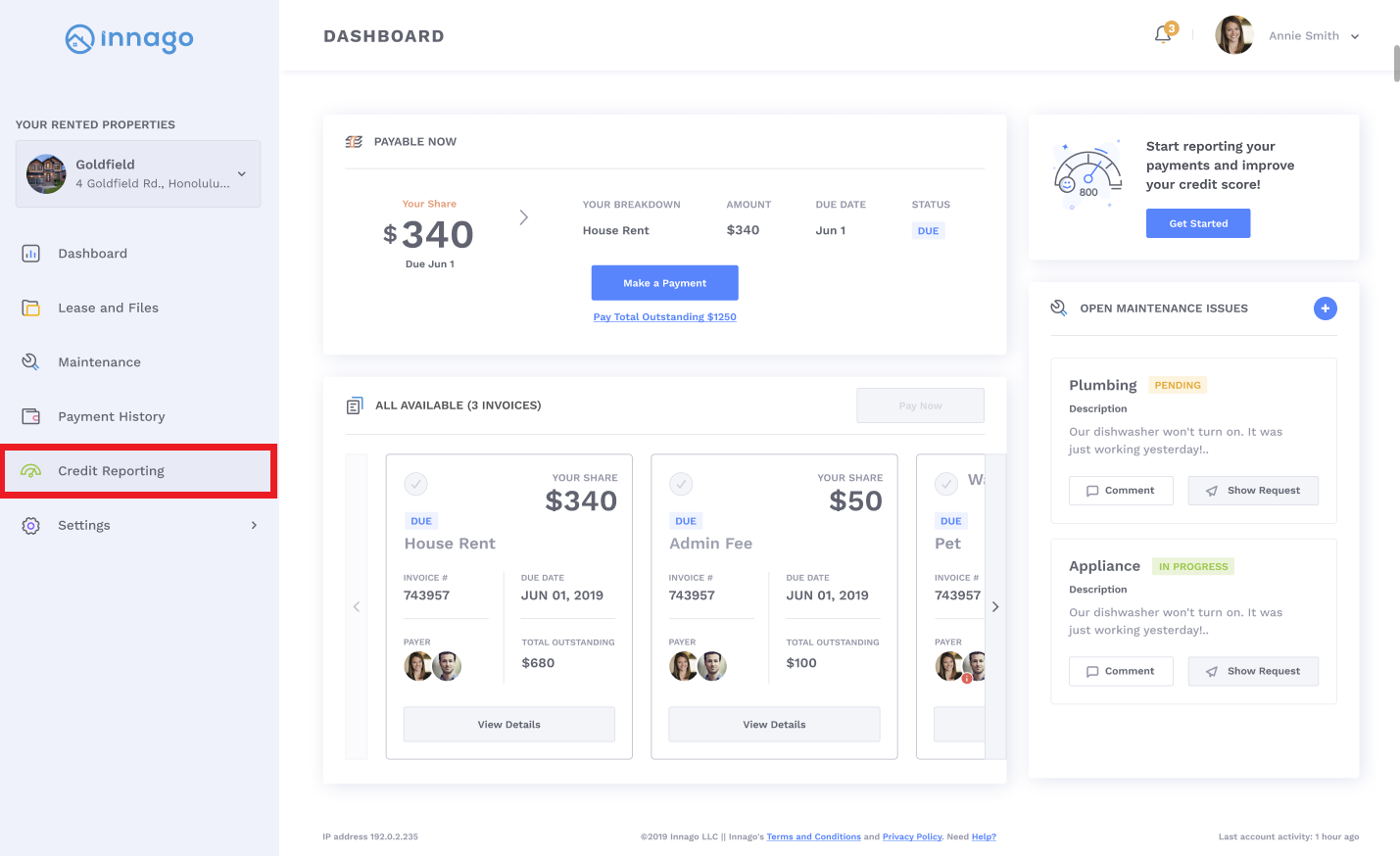

Tenants interested in building their credit while making rent payments can enroll in our credit reporting service directly from within their account. They’ll get started by simply clicking the “Credit Reporting” tab on their main menu.

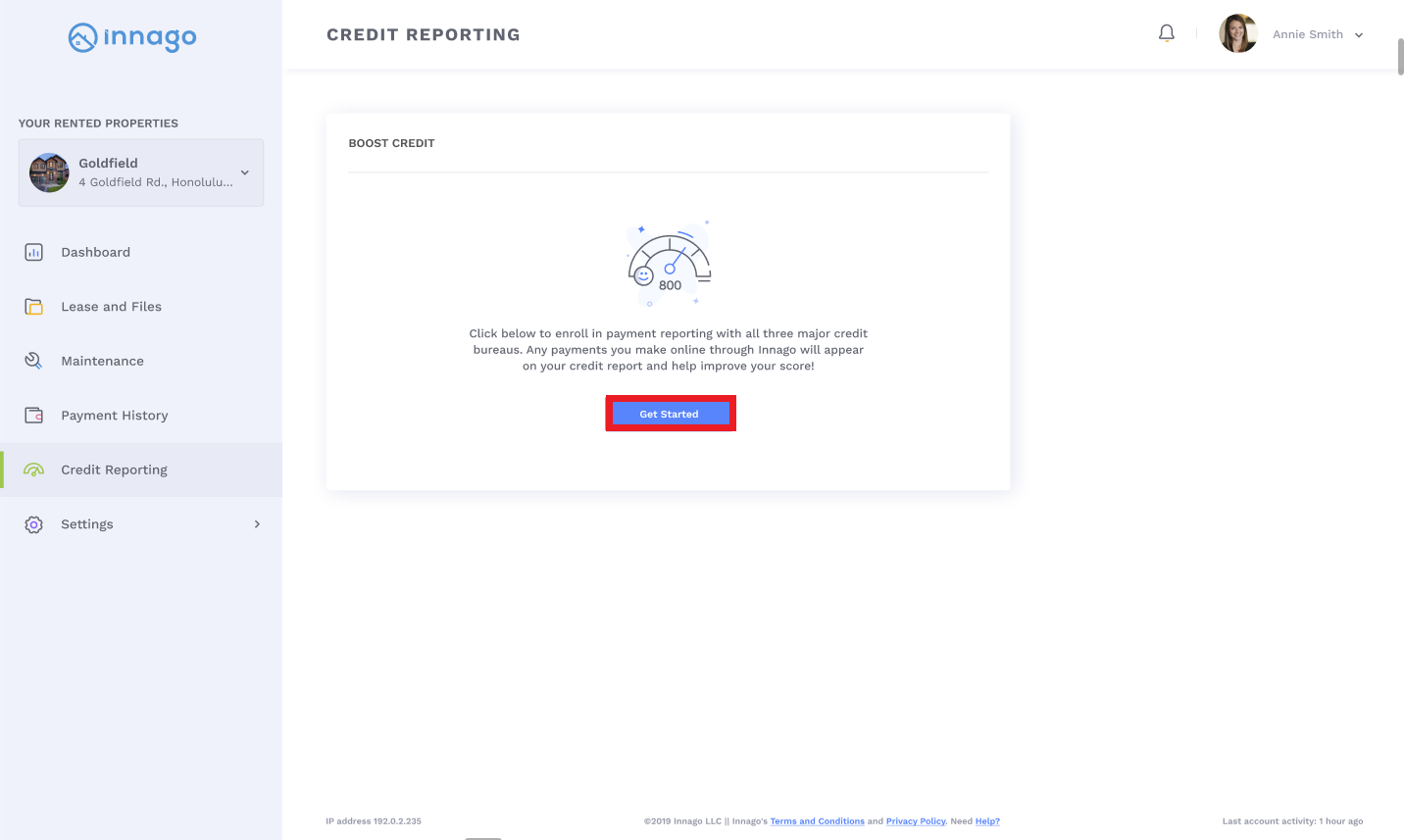

Tenants will then click “Get Started” to proceed.

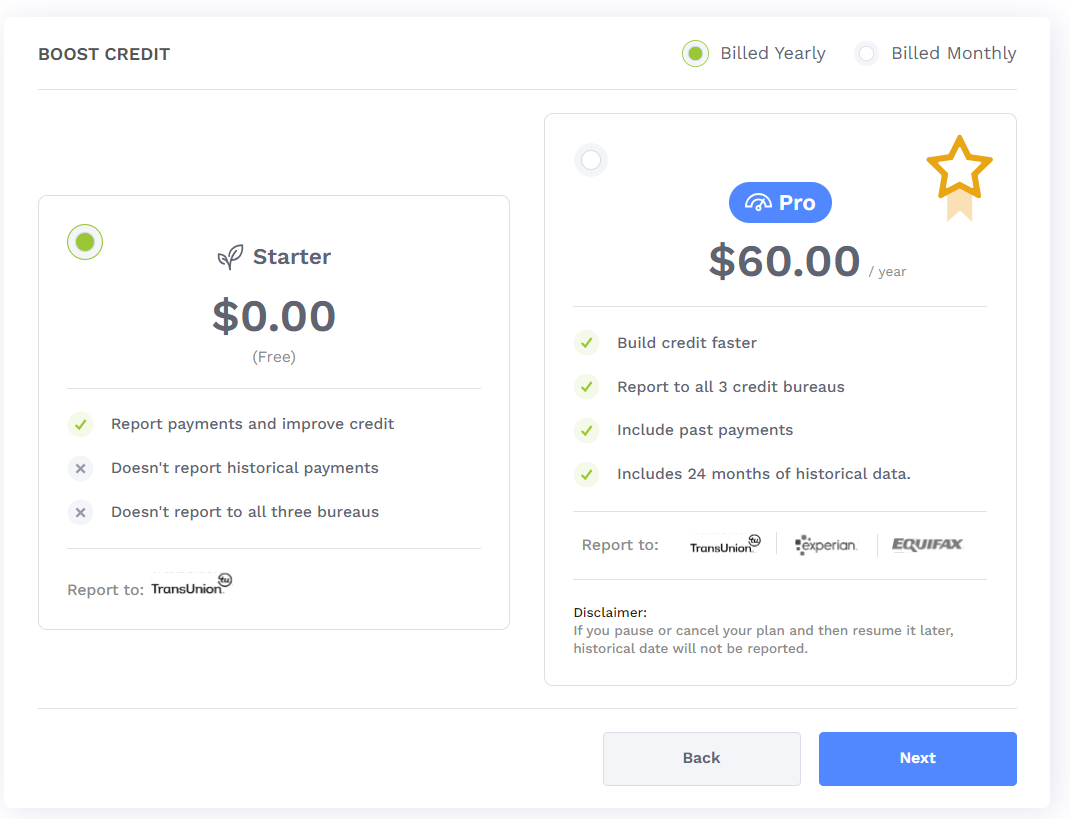

From here, they can either choose the “Starter” version of credit reporting or the “Pro” version. The Starter version is free, but only includes payment reporting to TransUnion. The Pro version costs $5.99 per month or $60 annually, but also includes reporting to ther other two bureaus, Experian and Equifax. Please note, any billing for Pro Reporting is non-refundable.

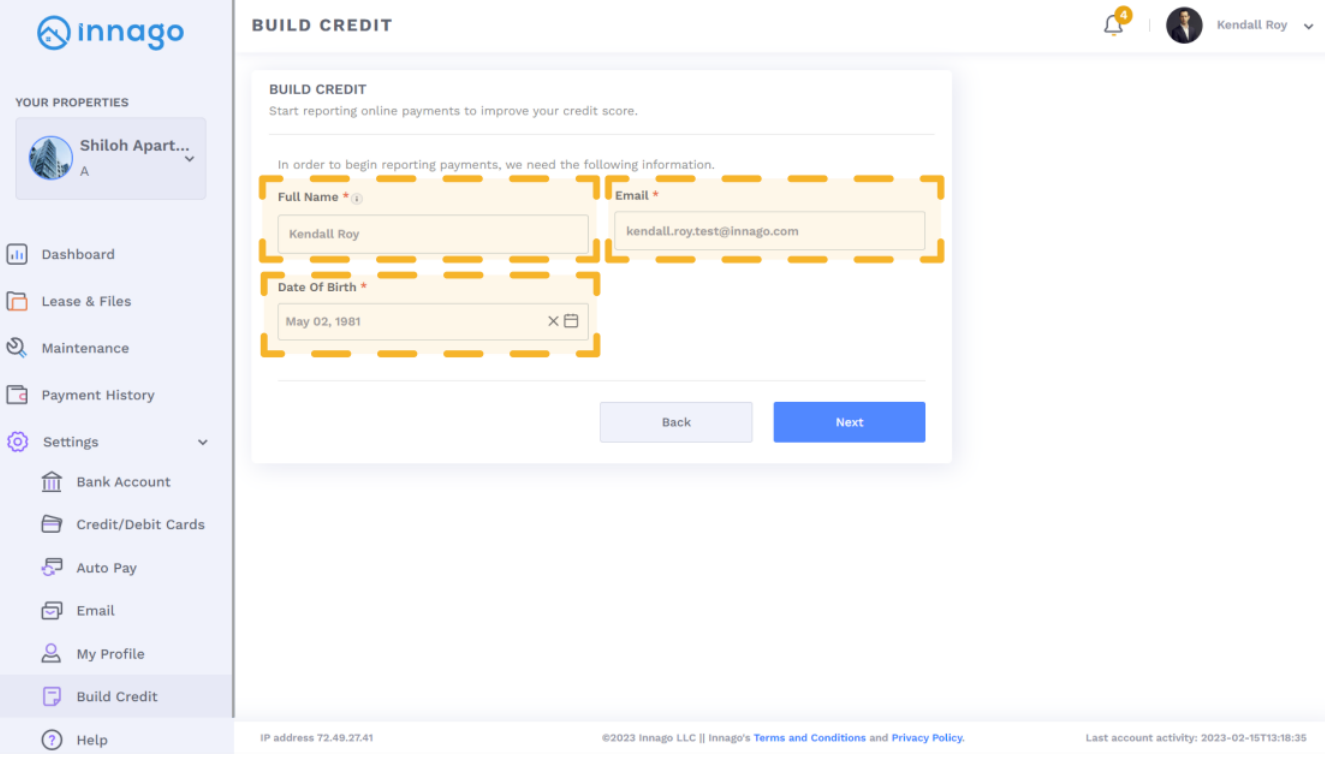

After making their selection, tenants will then be required to provide details such as:

-

Full Name

-

Email Address

-

Date of Birth

*We do not require a tenant’s SSN. If more information is required, tenants will be contacted by the respective bureau based on the contact information we have on file.

Once tenants have submitted their details, all rental payments that tenants make on invoices moving forward will be reported on the 15th of every month. If they enrolled in “Pro” reporting, their historical payments will also be reported on the 15th of the following month. Please note, late payments will not be reported.

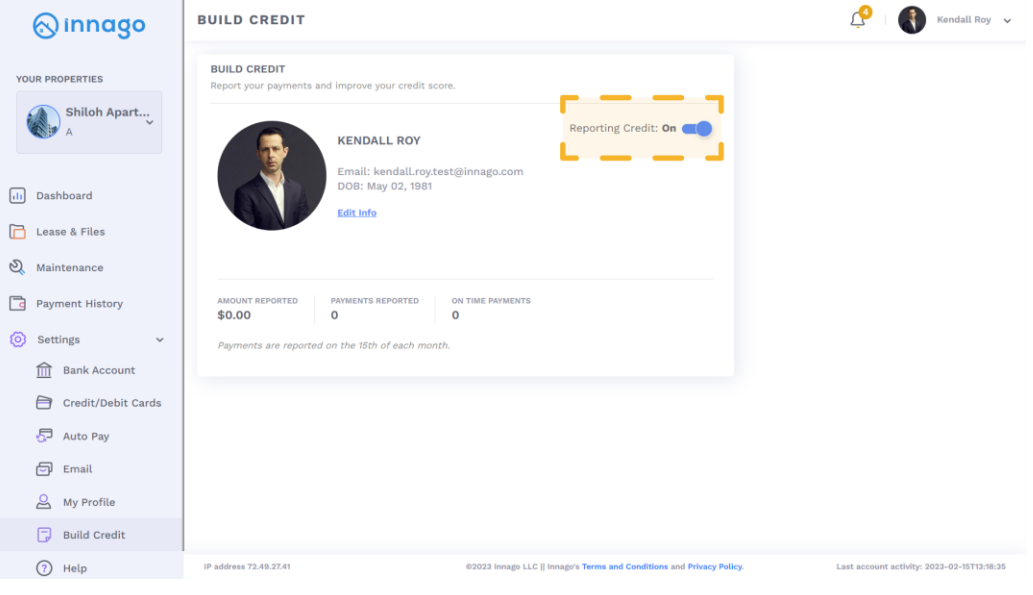

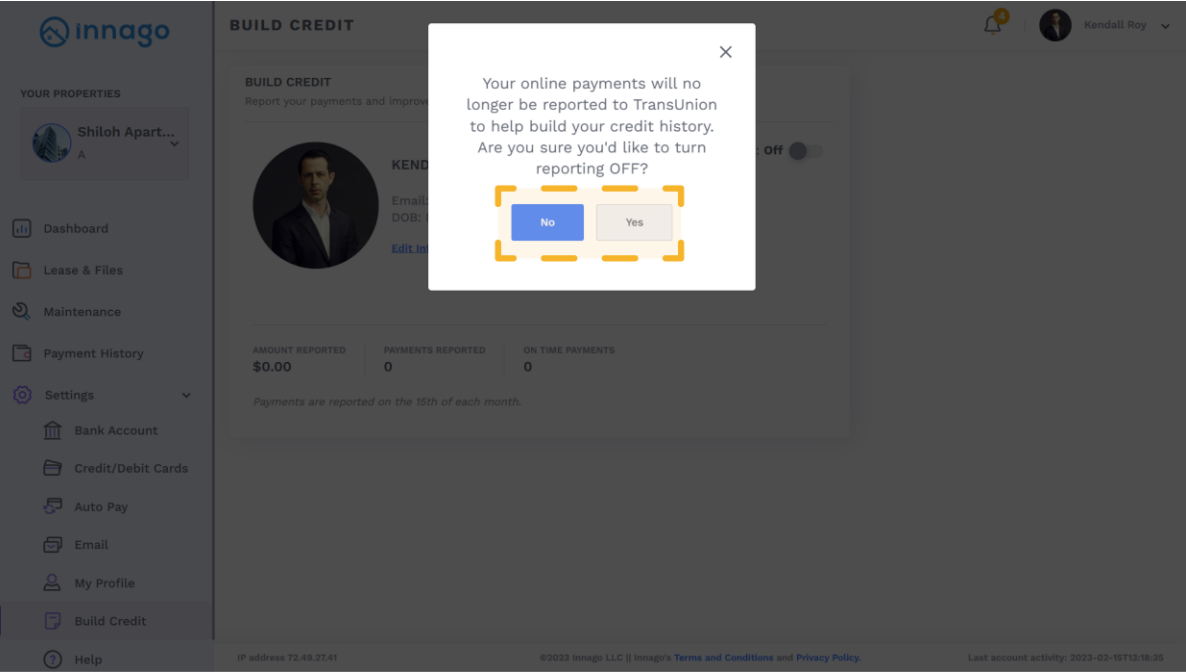

PLEASE NOTE: Landlords cannot enroll or disenroll tenants in credit reporting. Only tenants can enroll and disrenoll themselves from within their account. Tenants can enroll or disenroll at any time by using the “Reporting Credit” toggle shown below.

We have certain rules to keep in mind for this feature:

- For the free version, only payments made after enrolling will be reported. This means no payments made prior to enrolling will be reported, unless tenants are enrolled in the Pro version.

- Under the free version of credit reporting, only payments processed by Innago will be reported. Any payments collected offline (cash, check, money order etc.) will not be reported. Under the Pro version of credit reporting, we will include offline payments as apart of the (up to 24 months of) historical data that we report upon enrollment. Any offline payments made after enrolling will not be reported, regardless of whether tenants are enrolled in the free or Pro version of credit reporting.

- We report payment data on 15th of every month. This includes any historical payments from Pro reporting as well.

- There is a gap of 7 days from when a tenant makes a payment to when the data enters the Reporting Document that would be sent to the credit bureaus (this is keeping normal payment processing times in consideration). For example if a payment is made on the 9th of the month, it would enter the Reporting Document on the 16th, and would not be submitted for reporting until the 15th of the following month.

- On invoices that are shared by multiple tenants, only tenants who submit payments and are actively enrolled will benefit from reporting. For example, if one roommate pays the entire invoice, even if both are enrolled in credit reporting, only the roommate who submitted payment will have a payment reported.

- Reporting only occurs on an active leases, and no future lease or future invoices.

- Payments made as part of Security Deposit, Pet Deposit, Application Fee and Reversal Fee etc. will not be reported. Rent and all other line item types will be reported.

- Payments can only reported for one lease per tenant. If you are a tenant of multiple leases at once, we will report the payments that are most beneficial towards building your credit.