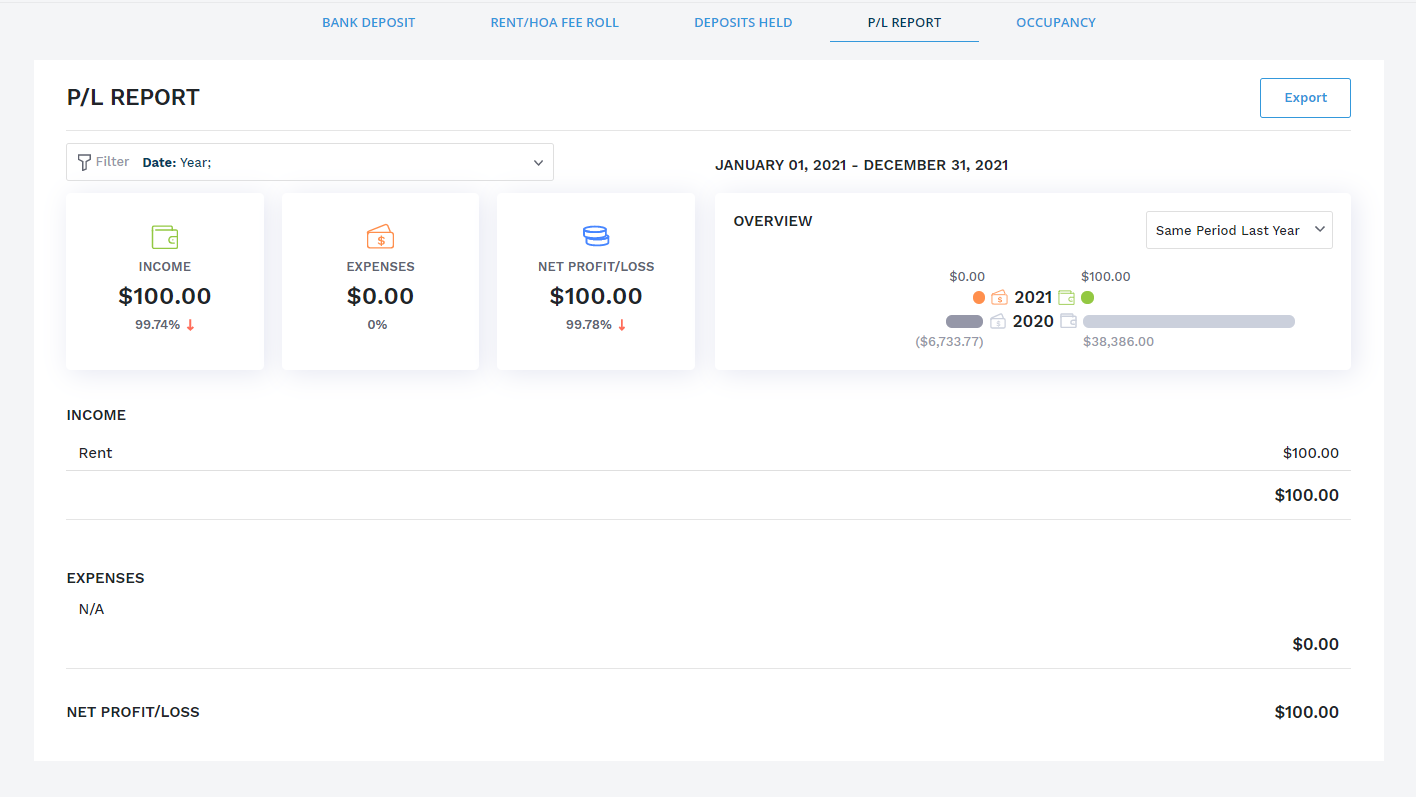

A profit and loss report is a financial statement that summarizes the revenues, costs and expenses incurred during a specified period, usually a fiscal quarter or year. It helps to quickly ascertain how much profit or loss was generated by the business.

To view your P&L Report in Innago:

1. At the bottom left corner of the Innago menu, click ‘Reports’ (the page icon left of settings gear icon).

2. At the top of the screen, click ‘P/L Report’.

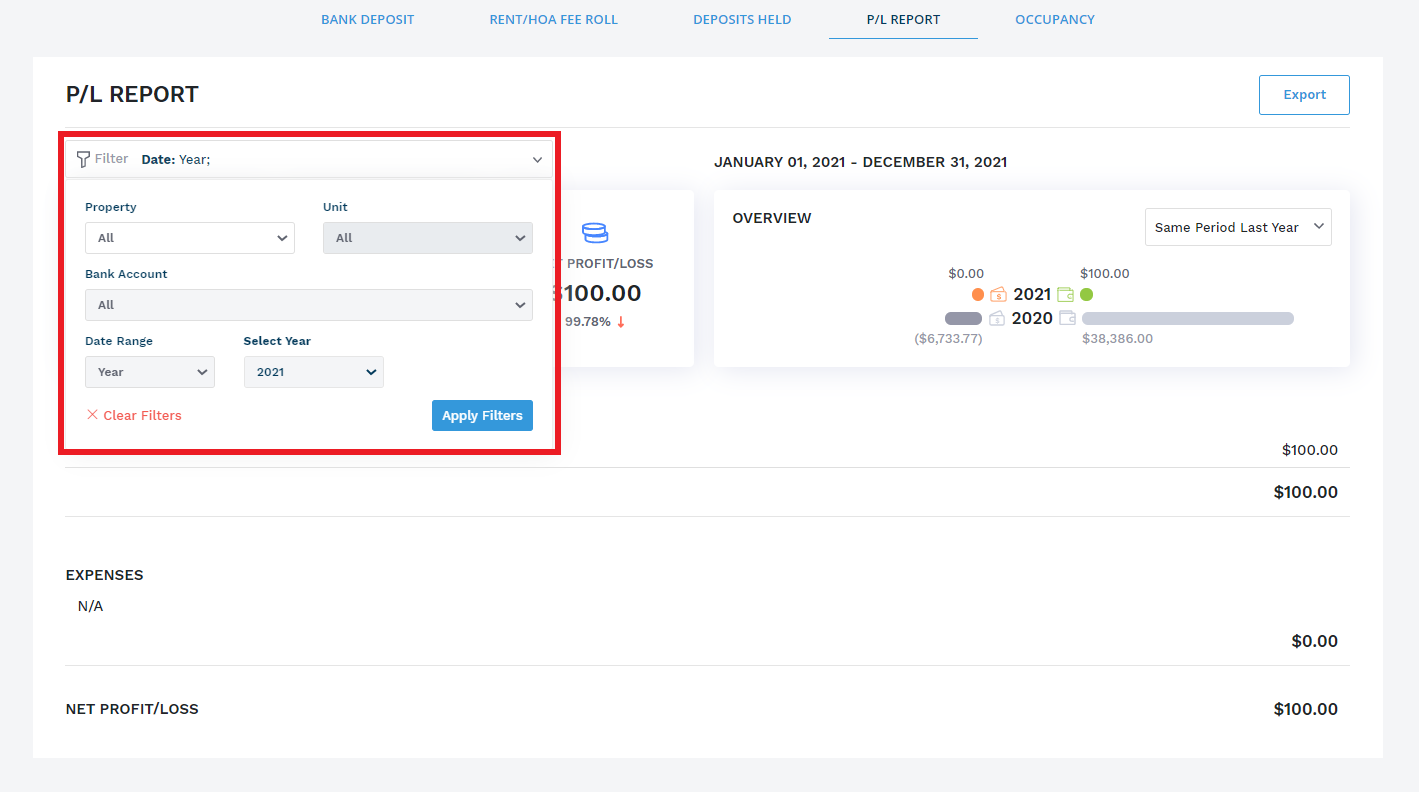

3. Be sure to use the filters as needed.

Please note, payments received for Security Deposits will not be considered income on the Profit & Loss Report. It is not considered income because it is essentially the tenant’s funds that you are just holding for them. Funds from a Security Deposit will only be considered income and reported on the P&L report if you apply them to an invoice. For more information on applying and returning Security Deposits, please click here.