Whenever you add a bank account to Innago, it must be associated with a taxable business entity. That entity could be an LLC, corporation, partnership or sole proprietorship. You’ll also need to provide a taxpayer identification number (TIN) for 1099-K reporting purposes.

Here’s how you’ll add a taxable entity:

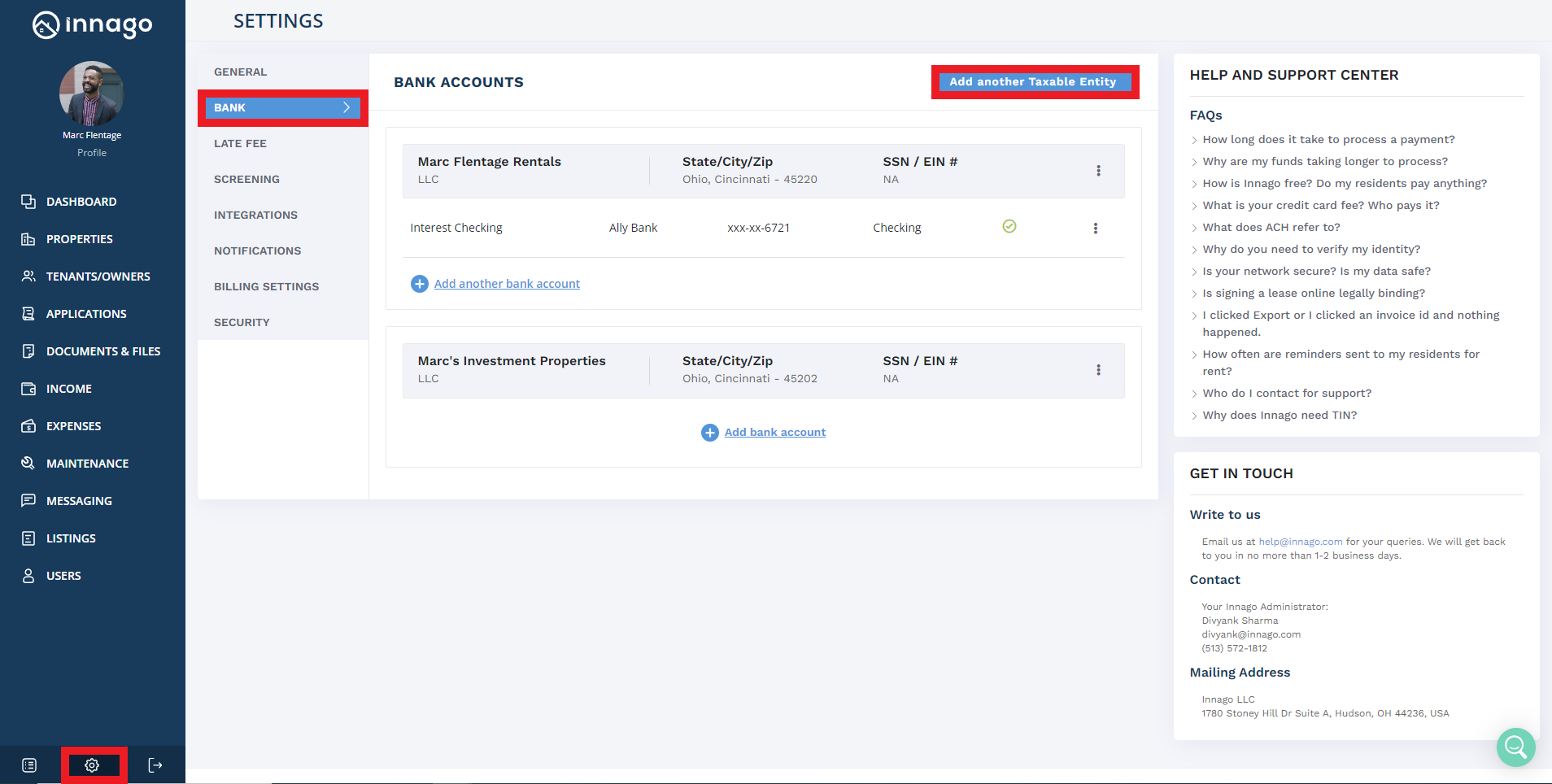

1. From the Innago menu on the left, click Settings (the gear icon).

2. From the Settings menu, select Bank.

3. Click either “Add Bank Account” if you haven’t previously added a bank account, or click the blue bar that reads “Add another Taxable Entity”.

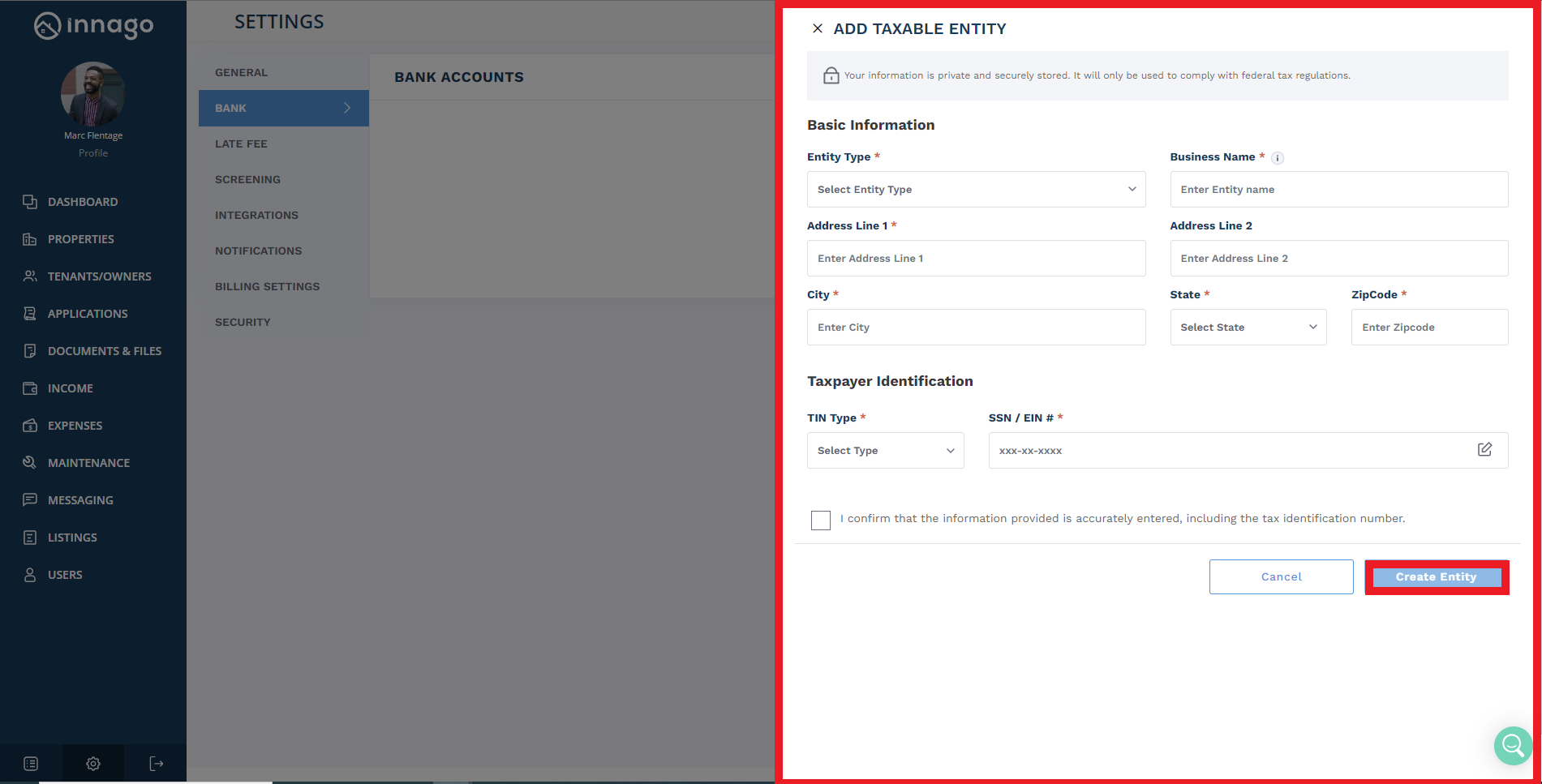

4. Type in your business entity’s name, address, entity type, and TIN information.

5. Click “Create Entity” to save your changes.

Once complete, you can then add a bank account to that business entity. You can follow the same steps to create multiple business entities as needed.

For more information about 1099-K tax reporting, please click here.

For instructions on how to edit a previously entered taxable entity, please click here.