Gathering all necessary information about your potential tenants is a crucial part of the application process. In addition to credit, criminal, and eviction reporting, we also allow you to request applicant Income Verification.

How Does It Work?

Innago makes tenant income screening easy, seamless, and accurate by giving applicants the following verification options:

-

Bank Verification: After applicants input their banking information, Innago’s verification partners automatically analyze their statements to determine the applicant’s average income.

-

Payroll Verification: Applicants can simply connect their payroll provider and allow Innago to confirm their exact income amount alongside important documents like W2s and paystubs.

-

Document Verification: If preferred, or if for whatever reason the applicant can’t complete the above options, they can always upload documents like paystubs or W2s. Innago’s verification partners will then analyze each applicant’s documents via machine learning (and if required use human intervention) to ensure they are valid. This is particularly useful to help root out tricky applicants who could otherwise present you false documents when filling out their application.

All of these options are completed via a direct integration with Plaid, a financial services company that specializes in verifying bank accounts, analyzing categorized transaction data, and verifying assets for lending.

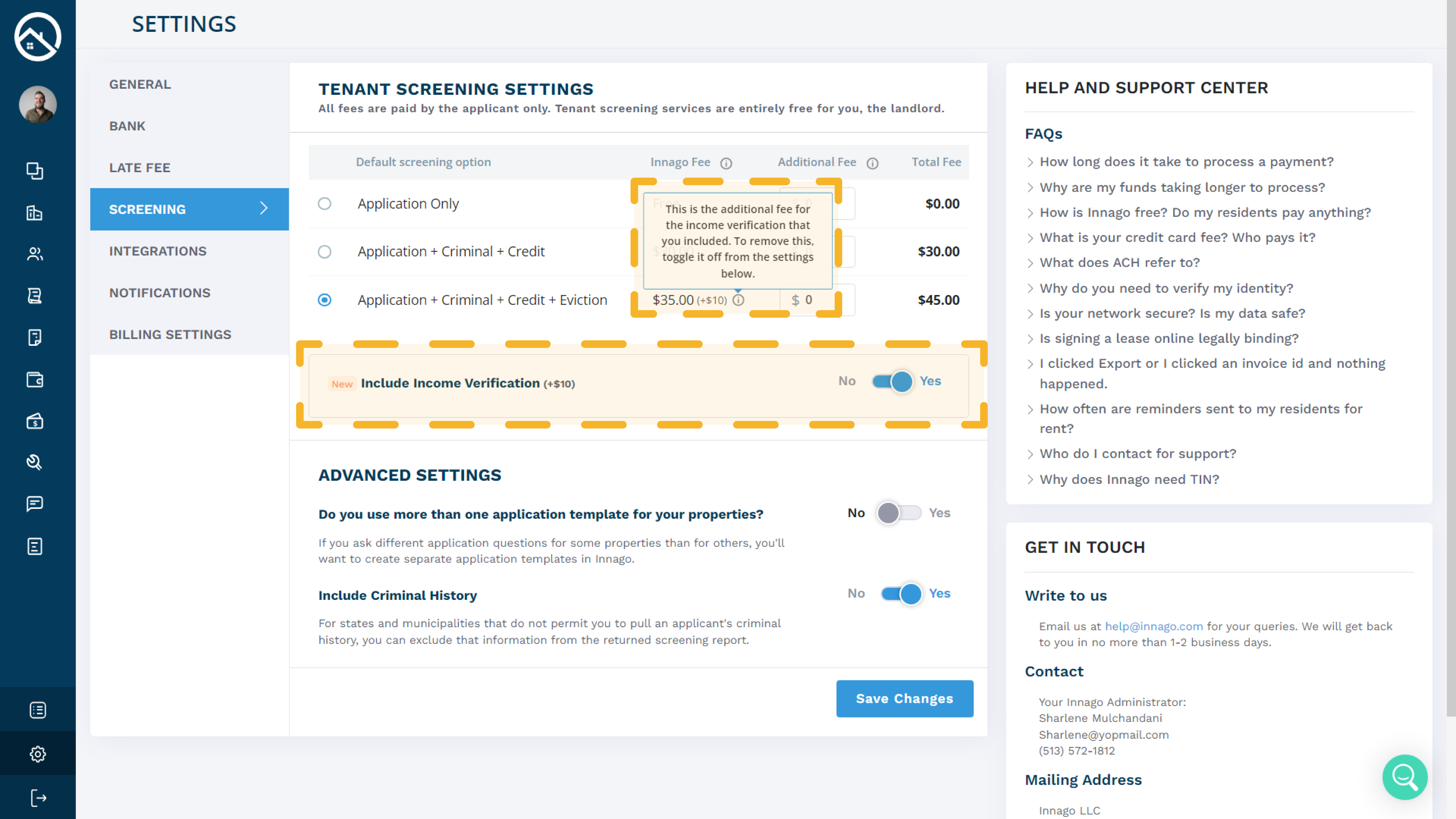

How Do I Enable Income Verification?

In order to enable Income Verification, you’ll go to your Settings, and then to the Screening tab. From there, you’ll move the toggle for Include Income Verification to “Yes” and save your changes. By including Income Verification, your chosen level of screening will have an additional $10 fee.

Please note, Income Verification is not available on the “Application Only” tier. It is only available as an add-on to the two paid tiers of screening.

After updating your screening settings, you can go to Applications from your main menu and click “Request Application”. For more information on how to request an application, please click here.

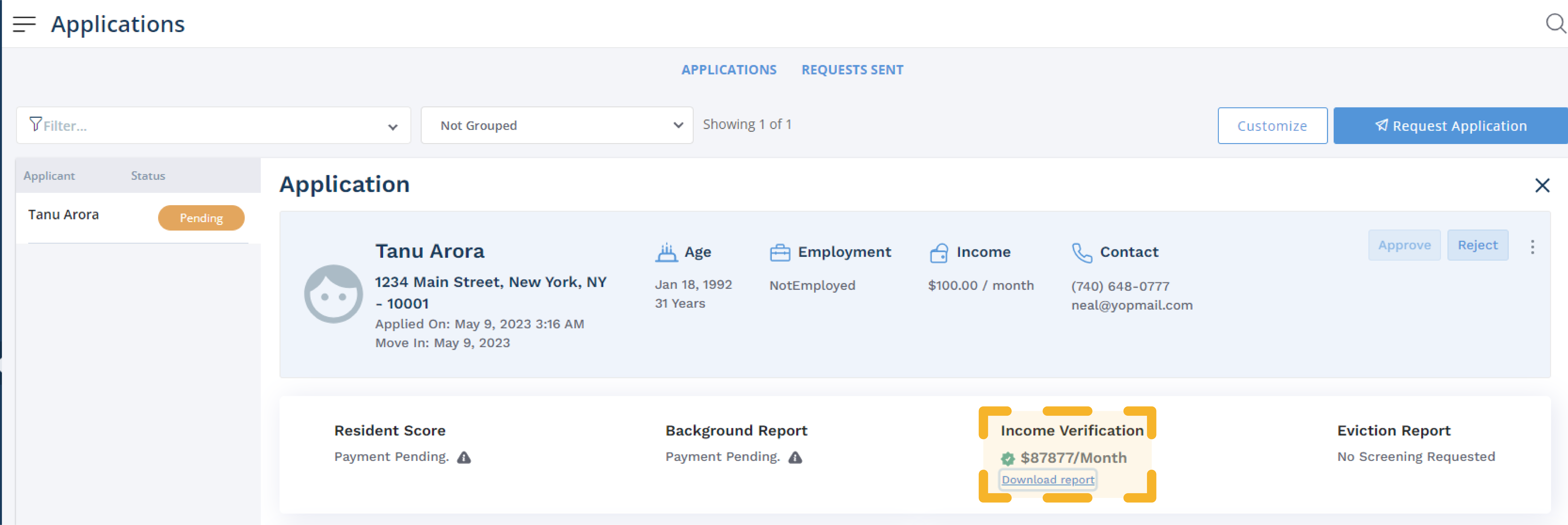

How Do I View The Income Verification Report?

Once your applicant has completed their application and its status is marked “For Review,” on the Applications page, you’ll select the application and click “Download Report”.

For more information on how to effectively review this report and others, please click here.

Please note, applicants are able to complete their application without verifying their income. In that case, their report will appear as “Unverified”:

Applicants who have not officially verified their income will still be able to do so by accessing their application again and clicking “Complete Income Verification”:

For a sample of the Income Verification report, please click the link below: